cebron group

New york city,

Description

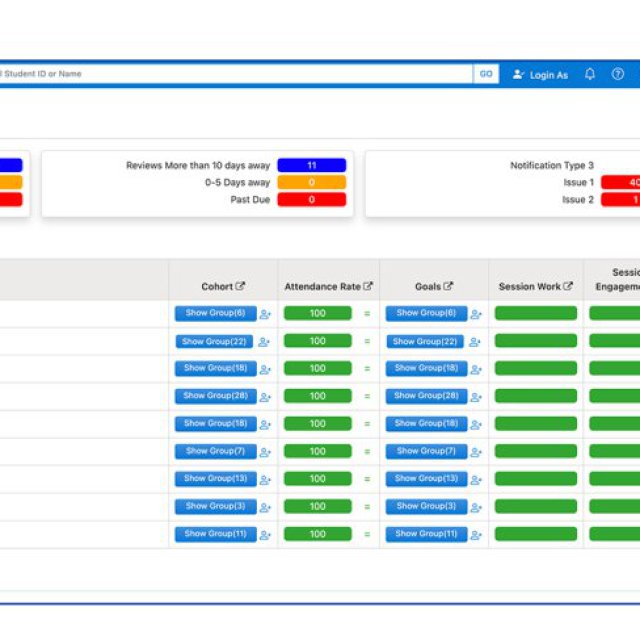

Private equity Exit is the motor driver of exit growth for periods. The main objective of this is to grow and take that on target. Private equity exit is capital that is not noted on a public exchange and is invested by established industries that are not performing well and are going through annihilation. There are mainly five ways to exit private equity, Cebron Group, Growth Capital, Leveraged Buyout, Mezzanine Debt, and Distressed Debt. Private equity exits are firms that are made up of funds and investors who invest directly in private companies or acquire company ownership through institutional and retail investors. But on the other hand, there is the Cebron Group which is a form of private equity exit, which invests in a new venture, and there is an unknown technocrat who has innovative ideas to develop a new product but does not have the capital of his own. . What is needed to turn their ideas into a successful business venture. The Cebron Group widely known as the Sabron Group comes to its rescue by providing risk capital. These provide capital for institutional and retail investors to exit private equity, and the capital can be used to support new technology, expand working capital, or accumulate balance sheets.

Cebron Group can be broadly defined as a long-term investment in a business that has the potential for significant growth and financial returns. It is usually offered as a private equity exit. ThusCebron Group not only invests money but also takes risks. Private equity exit organizations are firms that raise assets from foundations that include insurance companies, pension funds, and others. Rich people are also included in this. Which is invested to buy and sell the business with the money of Cebron Group.

Payment Details

Your Business Keywords

Reviews

To write a review, you must login first.

Similar Business

Working Hours

Location

Manager